After the long expected breakthrough for my first backtested system I had the chance to put in action on Monday.

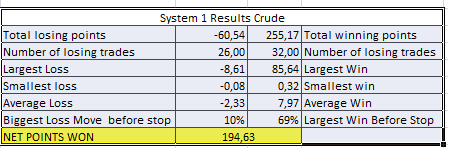

I tested the system for crude oil and below are the results:

As you can see the results are relatively better than the DAX.Only thing is the biggest percantage move against the trade before exit is triggered is higher than that of DAX. 10%vs 7%.

On the other hand ,largest win is impressive %69vs %32.

Another thing I realized while backtesting Crude oil data was the latest buy signal was on 25/05/2014 at level 104.20 and still valid.

Well, I closed my trade almost first thing in the morning at 102.85 and got long.And a lucky day to turn my position around.

Below is the daily chart for crude.It is right at the resistance.

Below is the daily result table for my trades.

The first two trades with no backtest were minus.Well,lets see how trading on System1 will result.

I m currently testing System 1 on different instruments. For each market profit taking percentages tend to be different.

With the data I have,for crude I will be looking at :(besides the obvious exit cases)

After 4% in favor take 25% first day the market closes lower than the previous day (for an up market)

After 8% in favor take 25% first day the market closes lower than the previous day (for an up market)

After 13% in favor take 20% first day the market closes lower than the previous day (for an up market)

After 19% in favor take 10% first day the market closes lower than the previous day (for an up market)

After 26% in favor take 10% first day the market closes lower than the previous day (for an up market)

take 10% when the exit conditions happen.

Obviosuly no secret math is behind these numbers.Just observation of the trades roughly. The optimal strategy would be definetly different.

20140609215431.png)

No comments:

Post a Comment